tax exemption malaysia 2017

However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. Before diving into the tax treatment.

For Corporates and Business Entities holding GSTIN For issuance of proper tax invoice by IndiGo please ensure that GSTIN name of GSTIN Customer and e-mail address is correctly mentioned at the time of booking whether made directly by you or through a travel agent.

. For instance if your taxable income per year. How much is the terminal fee for international and domestic flights. More particularly the term refers to the banning of the manufacture storage whether in barrels or in bottles transportation sale possession and consumption of alcoholic beveragesThe word is also used to refer to a period of time during which such bans are enforced.

The religion of the State of the Maldives is Islam. Prohibition is the act or practice of forbidding something by law. Islam is the religion of the Federation.

Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957. It allows diplomats safe passage and freedom of travel in a host country and accords almost total protection from local civil criminal and administrative laws. Islam shall be the one of the bases of all the.

But other religions may be practised in peace and harmony in any part of the Federation Maldives. An overview of Tax in Malaysia on Company Income Tax and Income tax rates at the rate of 25 reduced to 24 wef YA 2016 in Malaysia. 1 April 2016 to 31 March 2017.

Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Tax Exemption On Employment Income Of Non-Citizen. 30000 with an HRA of Rs.

By doing so you may receive a refund for some or. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. 2nd completed year.

Malaysia Brands Top Player 2016 2017. Superceded by Public Ruling No122017 29122017 - Refer Year 2017. Our experienced journalists want to glorify God in what we do.

Some organisations have joined IBFD in an Identity Federation. May 30 2017 at 558 pm. As a dependents of my husband ofw.

Full tax exemption is given for gratuities received for the following reasons. Revenue or profits based tax. Applicable for royalty income or special classes of income derived from Malaysia.

Failure to pay the monthly tax estimation by the 15th of the month a 10 penalty will be imposed on. 100 tax exemption on QCE incurred within 5 years and this is to be used for a statutory income offset of 70 or 70 exemption on income tax for a period of 5 years. An exemption exists only for the foreign-sourced income of banking.

Article 10 of the Maldivess Constitution of 2008. What is Philippine travel tax. Single Sign On What is this.

As a general rule is exempted from corporate tax. As per the revised tax exemption act effective April 1 2017 When you make donations above 500 to Akshaya Patra your donation amount will be eligible for 50 tax exemption under Section 80G of Income Tax Act. The exemption is calculated by reducing the donated amount from your taxable salary.

Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. Were planing for a vacation in taiwan with my children and my husband is an Ofw. Dividend distributions deriving from a qualified shareholding are subject to progressive tax rates on 4972 5814 for TY 2017 of dividends distributed - i.

Is living in a rented accommodation and pays a monthly rent of Rs. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. March 27 2018.

If your organisation has done so you can log on here using the credentials provided to you by your organisation. A Firm Registered with the Malaysian. The 2017 tax reform in the United States brought the statutory corporate income tax rate from among the highest in the world closer to the middle of the distribution.

So we are entitled for travel tax exemption. An application for the tax exemption can be submitted to Talent Corporation Malaysia Berhad from 1 January 2018 to 31 December 2023. Are the income received by these employees from loss of employment taxable or exempted in Malaysia.

Expat Tax Guides Read tax guides for expats provided by EY. The said income is deemed to be derived from Malaysia if. TAX SHELTER -- 1 An opportunity to use quite legitimately a relief or exemption from tax to pay less tax than one might otherwise have to pay in respect of similar activities or the deferment of tax.

There are virtually millions of. For any services wholly rendered outside Malaysia WHT exemption under the Income Tax Exemption No9 Order 2017 the Order would apply. In 1960 land tax contributed 6 of direct tax revenues and by 1967 in a report recommending the abolition of land taxes a committee chaired by Auckland accountant Lewis Ross noted that a mere 05 of total government revenue now came from land taxes.

Tax invoice will be issued to the e-mail address specified by you. Diplomatic immunity is a principle of international law by which certain foreign government officials are recognized as having legal immunity from the jurisdiction of another country. Exemptions Important information for institutions of higher learning.

Together you can give 22000 to each donee 2002-2005 or 24000 2006-2008 26000 2009-2012 and 28000 on or after January 1 2013 including 2014 2015 2016 and 2017. Government of Malaysia V MNMN. Article 11 of the Constitution of Malaysia.

The possibility of obtaining the benefit of an exemption from employment income taxation has been abolished by Law Decree number 1122008 which entered in force on 25 June 2008. This means the HRA tax exemption is done based on the following rules. Compensation For Loss Of Employment.

Exact rent paid reduced by 10 of salary. You are each entitled to the annual exclusion amount on the gift. The government did not act on the Ross recommendation to abolish land taxes.

An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Foreign Nationals Working In Malaysia - Tax Treaty Relief. Order 92 Rule 4 of the Rules of Court 2012.

The government is also considering increasing the tax exemption threshold on profits up to 30000 from 13 percent to 15 percent. 2 The polite term usually given to a contrived scheme to. He receives a basic salary of Rs.

10000 during the fiscal year 2017-18 the assessment year 2018-19. Failure to submit tax estimation liability Form CP204 will be subject to a fine of RM200 to RM2000 or imprisonment or both. In response to COVID-19 we have temporarily suspended reviews into unassessed academic qualifications.

1st completed year 1 April 2017 to 31 March 2018.

Pdf Political Connections Corporate Governance And Tax Aggressiveness In Malaysia

Cross Border Data Flows Where Are The Barriers And What Do They Cost Itif

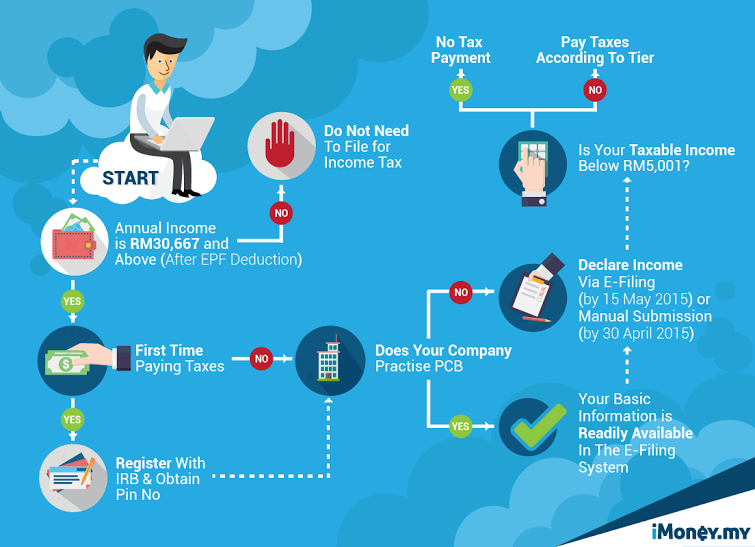

Incometax Handy Guide To Malaysia S Personal Income Tax Filing In 2016 Hype Malaysia

Why I Failed At Early Retirement A Love Story Financial Samurai

Corporate Tax Rates Around The World Tax Foundation

Newsletter 56 2018 Guideline On Income Tax Exemption For Religious Institution Or Organization Under Income Tax Exemption Order 2017 Page 001 Jpg

Paying Property Tax In Malaysia Here S Your 2017 2018 Guide Wise Formerly Transferwise

The State Of The Nation Should Epf Tax Relief Be Reduced Next Year The Edge Markets

Malaysia Expects 2m Medical Tourists By 2020 Laingbuisson News

Wage And Tax Statement Pdf Social Security United States 401 K

Evs In Malaysia To Be Completely Tax Free In 2021 Zero Import And Excise Duties Free Road Tax R Electricvehicles

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Which U S Companies Have The Most Tax Havens Infographic

My Tax Espresso Deloitte Us Audit Consulting Pdf Documents

Newsletter 65 2018 Withholding Tax On Special Classes Of Income Page 002 Jpg

Malaysia Bracing For Taxation Of Foreign Sourced Income

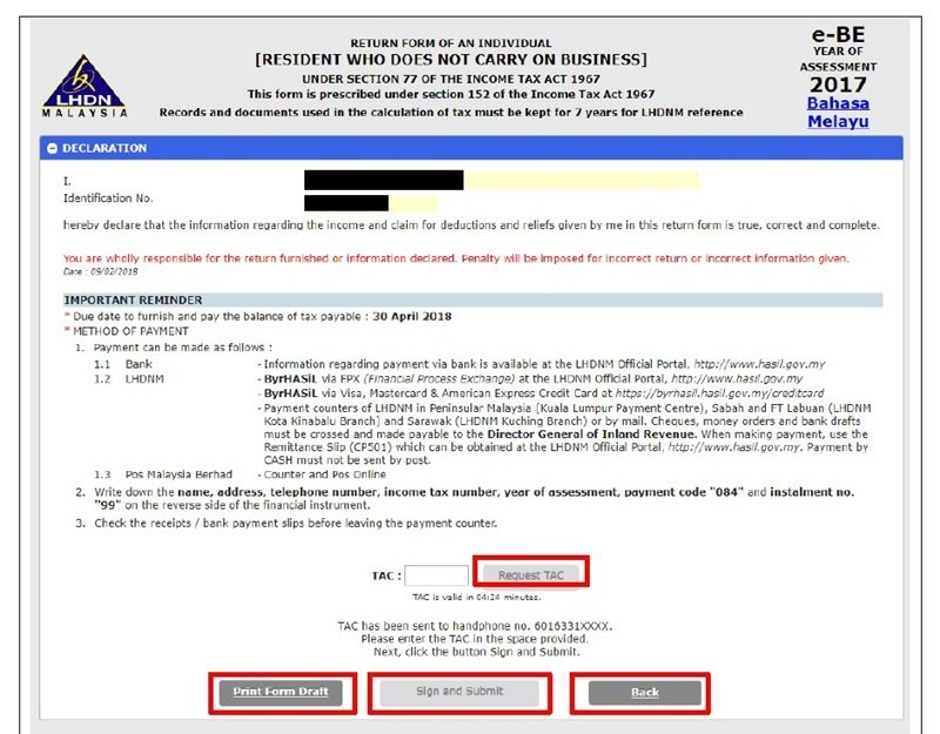

Malaysia Personal Income Tax Guide 2020 Ya 2019

Food Stamps And Sales Tax Exemptions Wolters Kluwer

0 Response to "tax exemption malaysia 2017"

Post a Comment